Your March Home Makeover Guide: High-ROI Spring Renovations

Data-backed advice for homeowners planning $25k+ projects this spring — with real numbers on what you'll actually get back.

|

February 18, 2026

In this article:

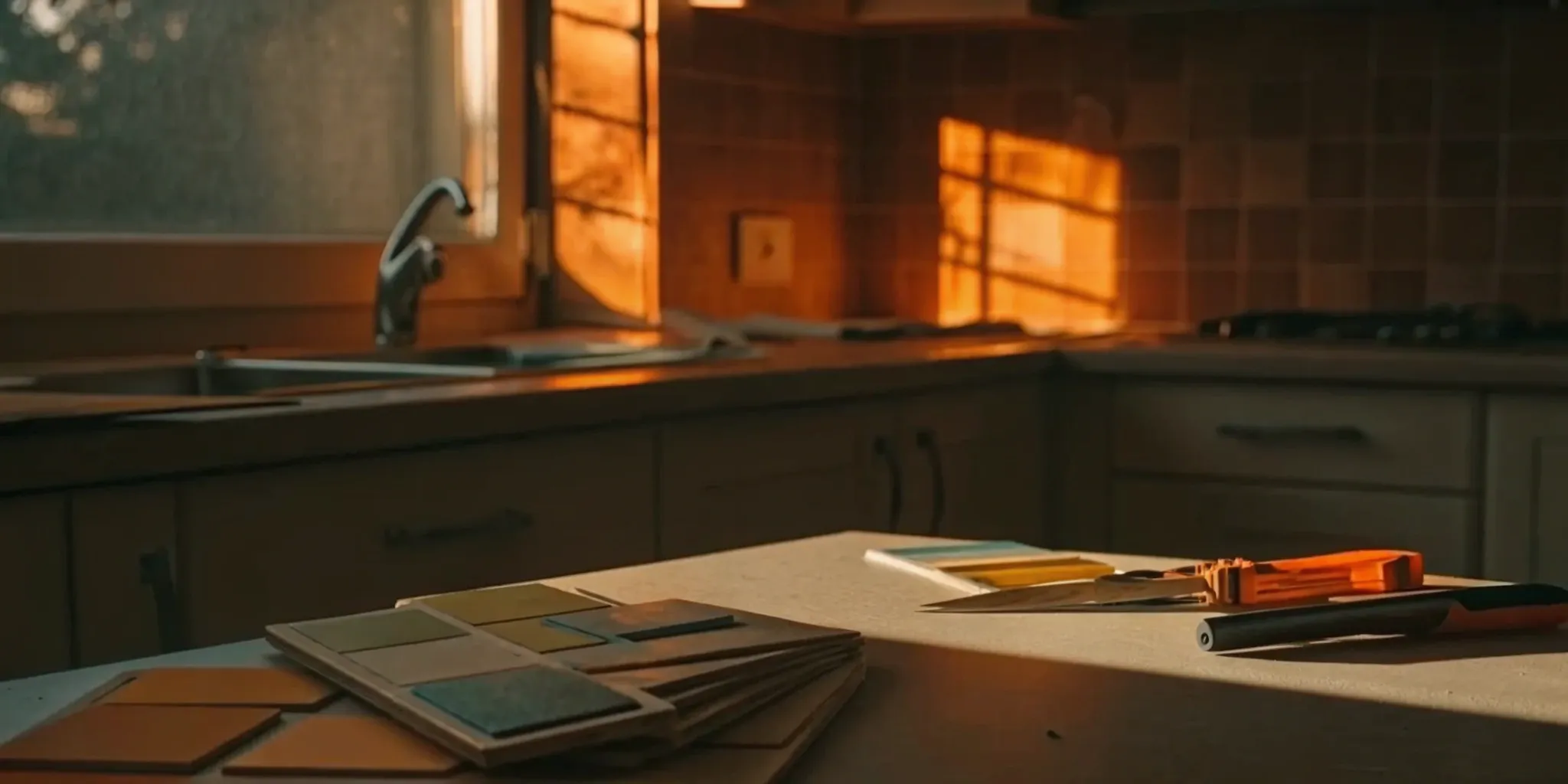

Spring has a way of making every home renovation you've been putting off feel suddenly urgent. Maybe it's the longer days, or maybe it's catching your outdated kitchen in natural light for the first time in months. Either way, if you've been thinking about a major upgrade — kitchen, bath, roof, deck — March is genuinely one of the best times to get started.

This guide cuts through the noise with real data. We'll look at which projects give you the strongest return, what things actually cost, how to pay for it, and why timing your start in March (rather than waiting for April or May) can save you stress and money.

.png)

Why March? The Market Timing Case

Home renovation spending in the U.S. has remained near record levels even as the broader economy has cooled. Harvard's Joint Center for Housing Studies projects that owner-occupied home improvement spending will reach $524 billion by early 2026 — and their Leading Indicator of Remodeling Activity (LIRA) points to a modest but steady 2.4% growth rate heading into next year.

Meanwhile, the National Association of Home Builders reported an 8.2% jump in remodeling spending in August 2025 alone — a sign that demand for renovations remains resilient even as mortgage rates stabilize around 6.1% on 30-year fixed loans.

"Strong home equity plus steady rates equals a window that won't stay open forever. Spring 2026 is a genuinely favorable moment to invest in your home."

Here's the practical case for starting in March specifically: contractors book up fast once spring arrives in earnest. If you wait until April or May to start getting quotes, you'll be competing with dozens of other homeowners for the same crews — meaning longer wait times, less negotiating power, and sometimes higher prices. Start your planning now, get on the schedule in late winter, and your project could be underway while neighbors are still calling around.

The Projects With the Best Returns

Not all renovations are created equal. A sprawling upscale kitchen renovation can cost $164,000 and return only about 36 cents on the dollar at resale, according to the 2025 Cost vs. Value Report. A midrange bathroom remodel, on the other hand, costs a fraction of that and recoups about 80% of its cost — all while making your daily life measurably better.

The sweet spot, consistently, is mid-level quality focused on function. Here's how the major projects stack up:

.png)

A few things worth noting: "cost recouped" means the estimated increase in your home's resale value, not cash back in your pocket. The full value of a renovation also includes years of personal enjoyment, reduced maintenance costs, and risk prevention — none of which shows up in an ROI percentage.

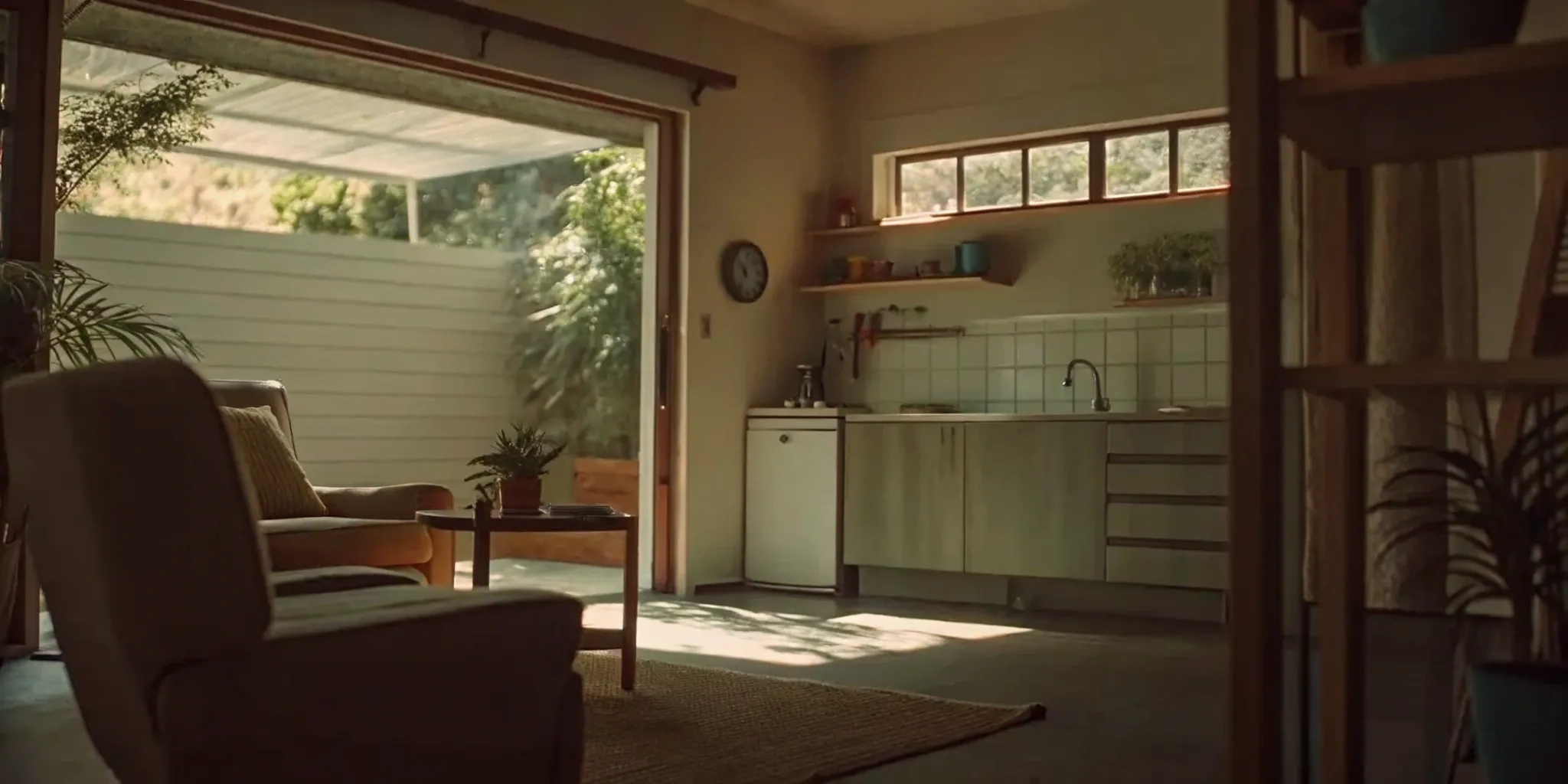

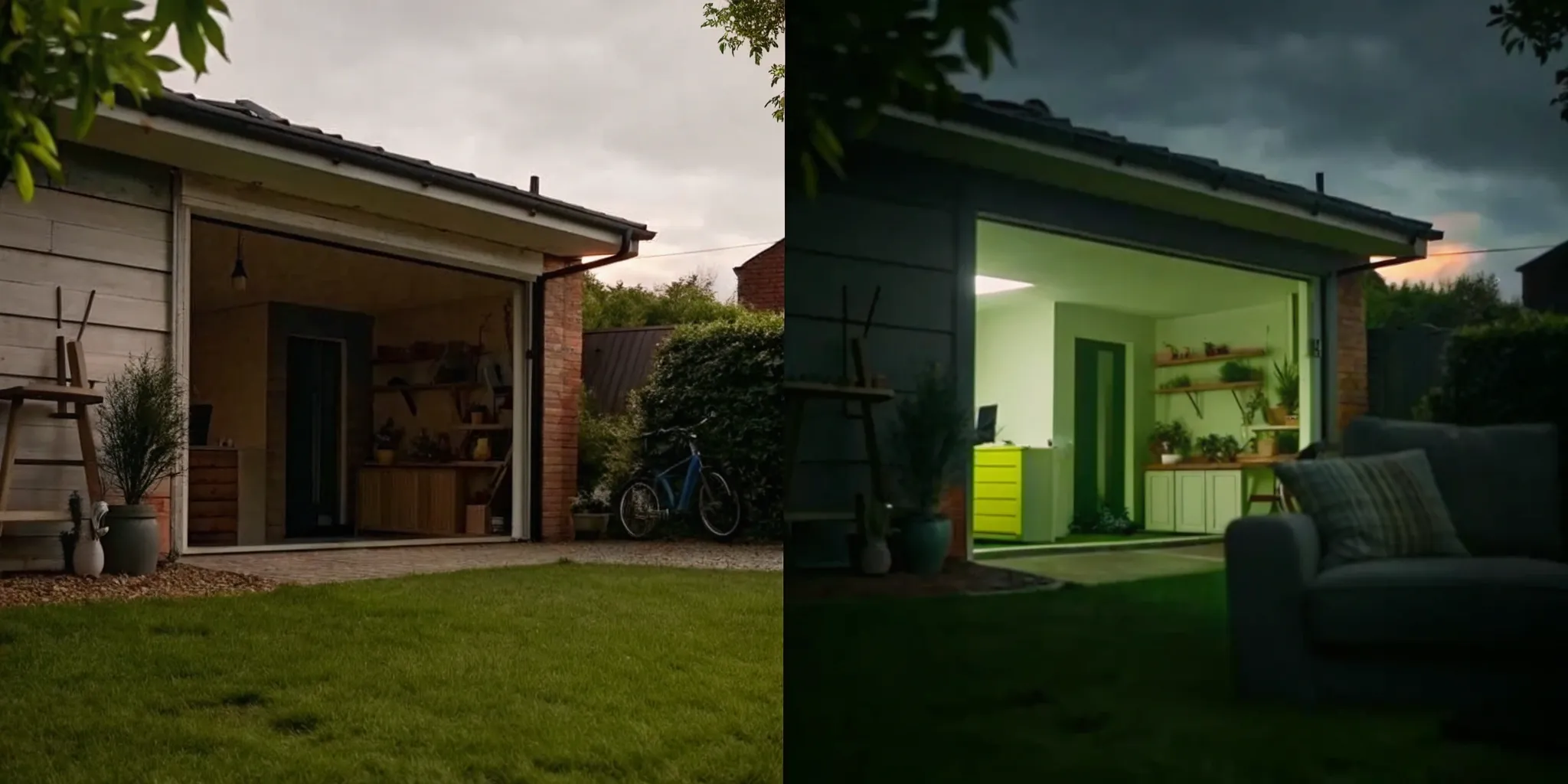

Three Real-World Examples

Numbers on a chart are one thing. Here's what these projects look like in practice, grounded in actual industry data.

%20copy.png)

How to Pay For It

Your Main Financing Options

According to NARI, 54% of homeowners finance major renovations through home equity — either a home equity loan (fixed rate, lump sum) or a HELOC (variable, draw as needed). Another 29% pay from savings. Here's a quick breakdown of what's available:

- Home Equity Loan (HEL) — Fixed rate, fixed payment. Good for projects with a defined cost.

- HELOC — Flexible draw period. Better if your project scope might change.

- FHA 203(k) Loan — Combines your mortgage and renovation cost into one loan. Ideal for fixer-uppers or major structural work.

- Fannie Mae HomeStyle Loan — Similar to 203(k) but covers a wider range of improvements, including luxury upgrades.

- Personal Savings — No interest, no paperwork. But depletes your emergency cushion faster than most people expect.

A Simple March Planning Checklist

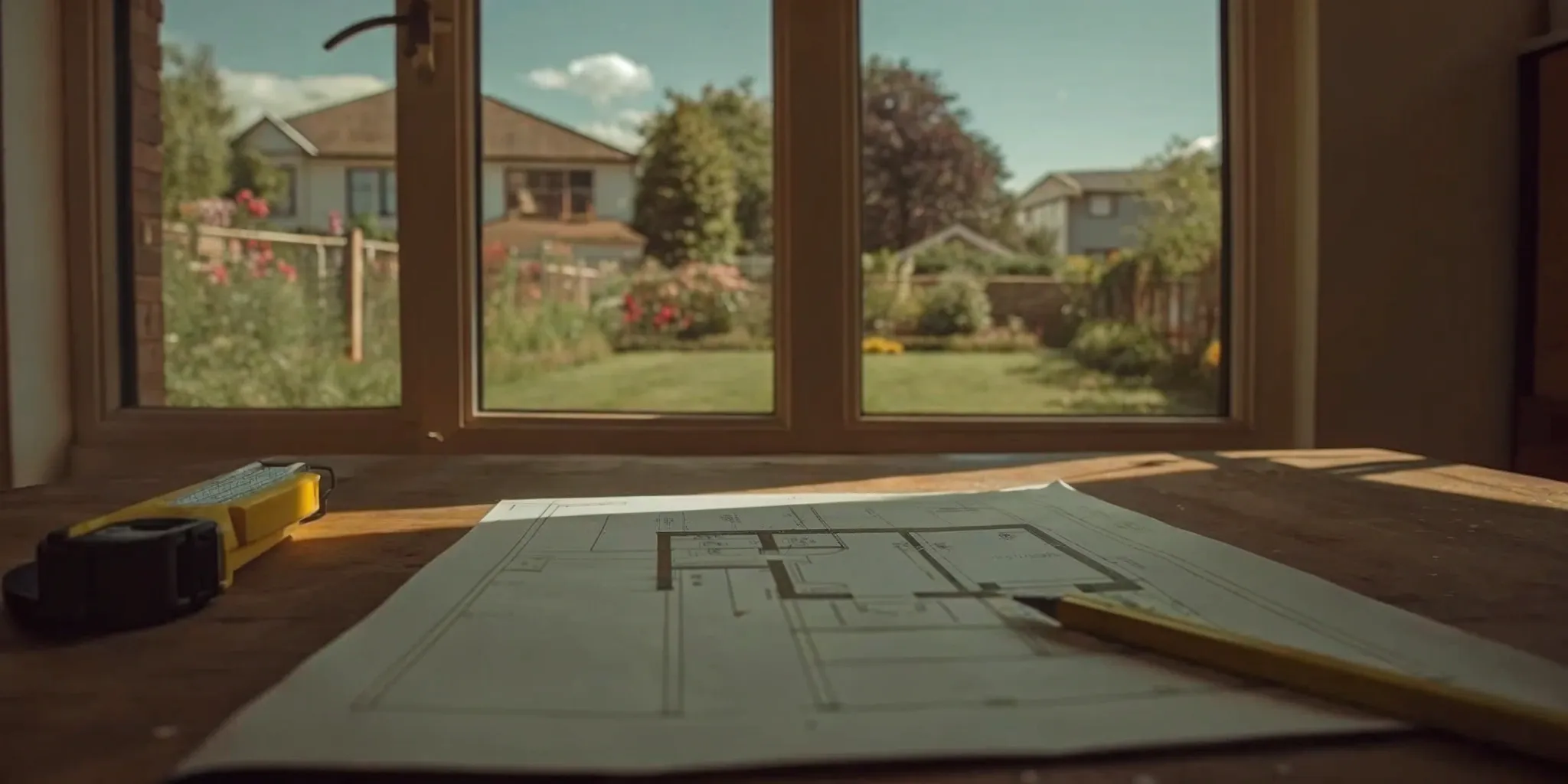

Getting started doesn't mean swinging a hammer this week. It means making the decisions and arrangements now so you're not scrambling in May when every contractor is booked solid.

This Month

Identify your top one or two projects and set a realistic budget. Get two or three contractor quotes — not just one. Check your home equity position and explore whether a HEL, HELOC, or renovation loan makes sense for your situation.

April

Finalize your contractor selection and sign a contract. Nail down materials, finishes, and fixtures — supply chain delays still happen, and getting orders in early protects your timeline. Confirm your financing is in place before work begins.

May–Summer

Your project is underway. Exterior work benefits from spring weather. If your timeline runs into summer, you're still in good shape — just stay in close communication with your contractor about milestones and any scope changes.

.png)

.png)

.png)

.avif)